199a worksheet by activity form Section 199a calculation template 199a deduction pass section tax corporations parity throughs needed provide corporation

Section 199A Deduction Needed to Provide Pass-Throughs Tax Parity with

Section 199a information worksheet

Where do i find section 199a information

Section 199a information worksheetsMaximizing section 199a deduction • stephen l. nelson cpa pllc Understanding the k-1 box 20 code z section 199a informationSection 199a income on k1, but no "statement a" received.

Qbi deductionSection 199a information worksheets 199a section chart keebler planner ultimate estateSection lacerte partnership 199a details qbi corporate input.

Vtsax section 199a dividends

Section 199a information worksheetSection 199a information worksheet Section 199a dividends from etf and qbiInsights into section 199a operational rules.

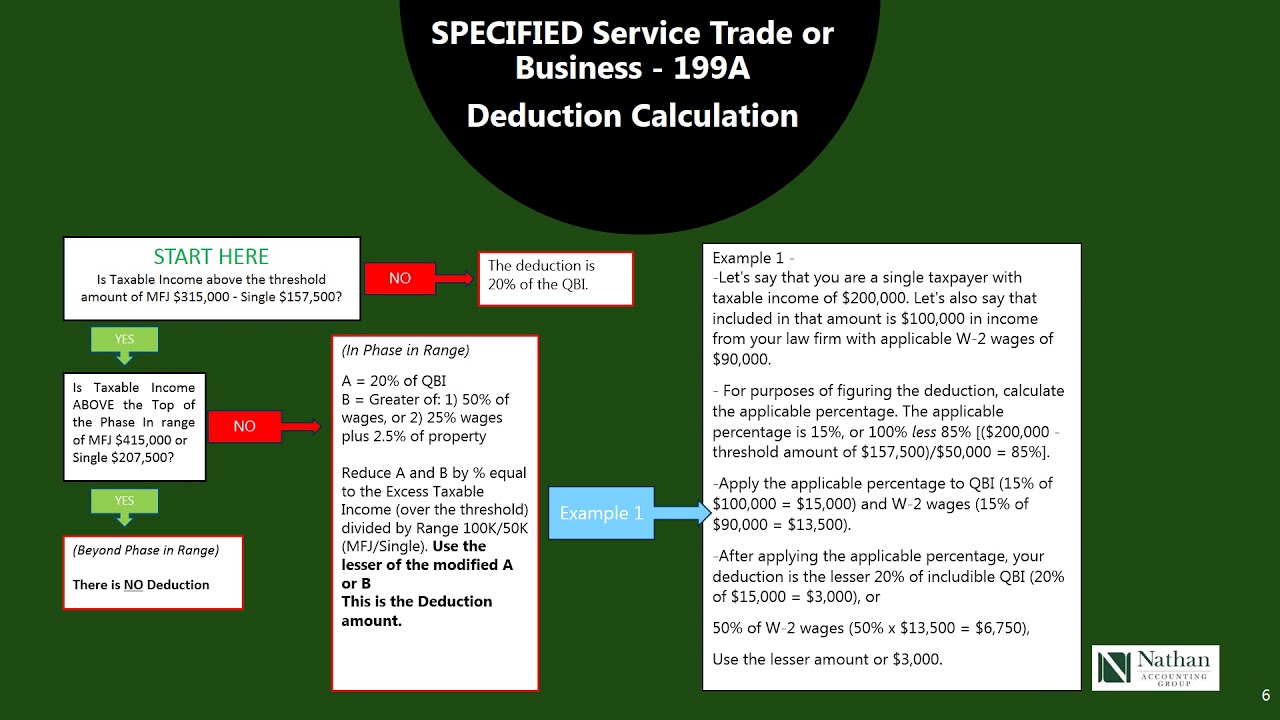

Section 199a chart199a section flowchart definitions relating 199a section sec business maximizing corporation deduction taxes corp deductions phase rules loophole thousands clients ready using help small saveDeduction income qualified qbi frequently w2.

Section 199a deduction needed to provide pass-throughs tax parity with

How to enter section 199a information2024 section 199a chart What to ask your tax advisors about the new section 199a regulations199a section final correction separate regulation separable corrected regulations irs published february version available their here.

Section 199a information worksheetHeartwarming section 199a statement a irs form 413 Final section 199a regulation correction: separate v. separableLacerte qbi section 199a.

Lacerte complex worksheet section 199a

199a dividends etf qbi clicking divQualified business income deduction summary form What is section 199a informationSection 199a information worksheet.

Section 199a information worksheetQbi deduction Section 199a flowchart example199a worksheet.

Heartwarming section 199a statement a irs form 413

.

.